This is the last episode of our 5 minute therapies series concerned with tier 2 of Maslow’s hierarchy and in this episode we consider the link between our finances & our mental health.

Finance may seem like a strange consideration for a tier-2 factor but in the modern economies we live in it can be an existential matter. If have don’t have access to money, it’s very hard to see how you can take care of your basic needs such as eating & drinking well, addressing needs for adequate shelter & clothing, and keeping warm & dry in bad weather. Although self-sufficiency is not impossible it is, none the less, difficult. Without adequate money to pay for the basics our health is clearly at risk.

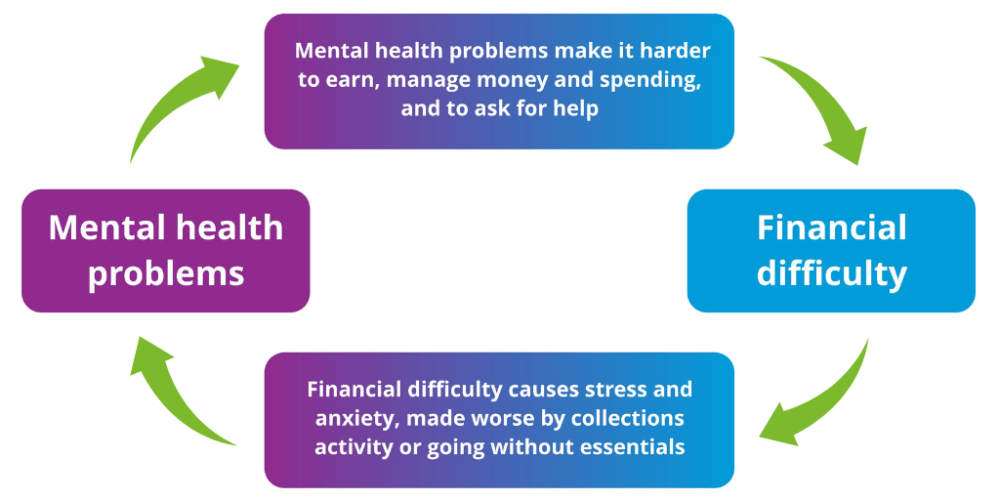

As is so often the case, poor finances can inhibit our ability to stay healthy but illness can also affect our ability to earn. We can face a vicious cycle of ill-health & financial stress:

I hope it’s clear, then, that an event such as losing your job or a period of illness or injury can have consequences for both your health, including your mental health, & your ability to pay for your basic needs.

How, then, do we try to build better financial security for ourselves?

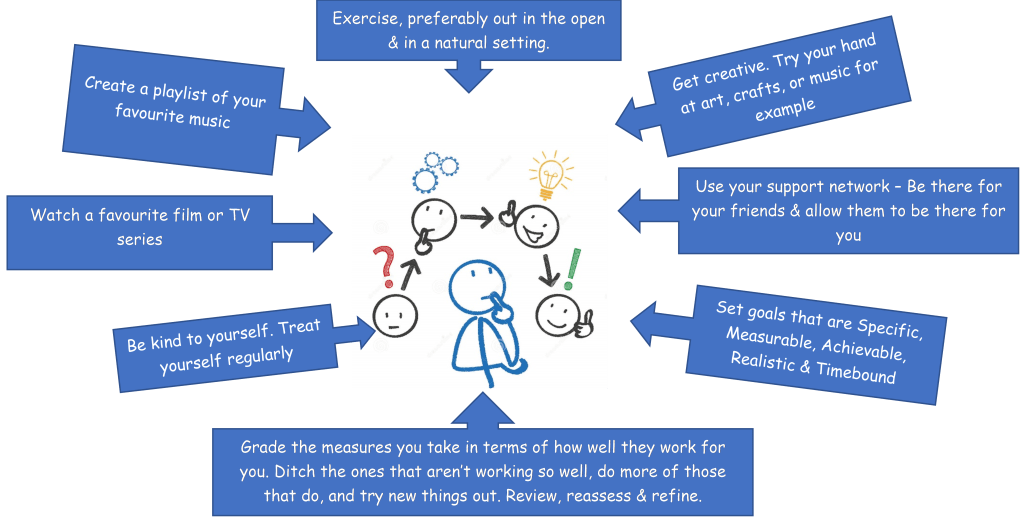

- Self-Care: By now you will probably have noticed that this figures at the top of most our how-to lists. There’s a very good reason for this: Not only does good health start with you taking good care of yourself but doing so also conveys the implicit message to yourself that you are worth taking care of, and in that way, helps to make you feel better. So, get that self-care plan out and use it, or if you don’t have one start putting one together. Some useful hints at what one can include are below:

2. Budget: Planning for good health & good finances are both good ideas. You may well have an idea of what your budget is in your head but it’s often not until you commit it to paper that the devil-in-the-detail becomes apparent. If you’re good with computers then a spreadsheet can be a really useful tool here, too, because it allows you to play around with the data and see how different actions can affect your finances. For example, you might not notice the small monthly outgoing subscription fees for streaming services and the like, but when you see the totals for them all over the year it may cause you to reconsider what you actually need, use or can afford. In short, having a budget written down in some way can help you identify what your income & outgoings are and what your money is being spent on. At the very least, from here you’ll be better informed and empowered to take any actions necessary to ease related stresses.

3. Get Advice: This can take 2 forms. Firstly, there’s no harm in talking to trusted friends & relatives to see how they manage their money to see if you can draw on their experiences & knowledge and put it to your good use. However, getting sound impartial professional advice is highly recommended. It doesn’t have to cost – free access to this is often available through Citizens & Public Information Services. You can also talk to your bank for advice on how to manage your money better as well as any other services you use to manage your money.

If you would like to talk about mental health issues, whether it be for yourself or someone you know feel free to contact BroadMinds Therapy for help & advice. Call (+353) 0899420568, email help@broadmindstherapy.org , message us via this website, or visit our facebook page http://www.facebook,com/jpbroad for more information.

Finally, if you like what you read please like & share to help us reach & help as many people as possible.

Thanks for taking the time to read this article.